Medicare Part D

Introduction

Medicare prescription drug coverage (Part D) helps you pay for both brand-name and generic drugs. Medicare drug plans are offered by insurance companies and other private companies approved by Medicare. Part D is insurance — you buy it so that it will protect you if and when you need it. If you don’t need any prescription drugs at the present time, enrolling in the Part D plan with the lowest premium in your area ensures that you have coverage if you suddenly need it, but at the least cost.

You can get coverage 2 ways:

1. Medicare Prescription Drug Plans (sometimes called “PDPs”) add prescription drug coverage to Original Medicare, some Medicare Private Fee-for-Service (PFFS) Plans, some Medicare Cost Plans,and Medicare Medical Savings Account (MSA) Plans.

2. Some Medicare Advantage Plans (like HMOs or PPOs) or other Medicare health plans offer prescription drug coverage. You generally get all of your Medicare Part A (Hospital Insurance), Medicare Part B (Medical Insurance), and Part D through these plans. Medicare Advantage Plans that offer prescription drug coverage are sometimes called “MA-PDs.”

Part D coverage excludes drugs or classes of drugs that may be excluded from Medicaid coverage. These may include:

- Drugs used for anorexia, weight loss, or weight gain

- Drugs used to promote fertility

- Drugs used for erectile dysfunction

- Drugs used for cosmetic purposes (hair growth, etc.)

- Drugs used for the symptomatic relief of cough and colds

- Prescription vitamin and mineral products, except prenatal vitamins and fluoride preparations

- Drugs where the manufacturer requires as a condition of sale any associated tests or monitoring services to be purchased exclusively from that manufacturer or its designee

Things to See When Picking out a Prescription Plans

– Deductible: If your plan has a deductible, you pay full price for your drugs until the deductible amount is met and coverage kicks in. “Full price” means the price your plan has negotiated with each drug’s manufacturer. This price may be less that you would pay retail at the pharmacy.

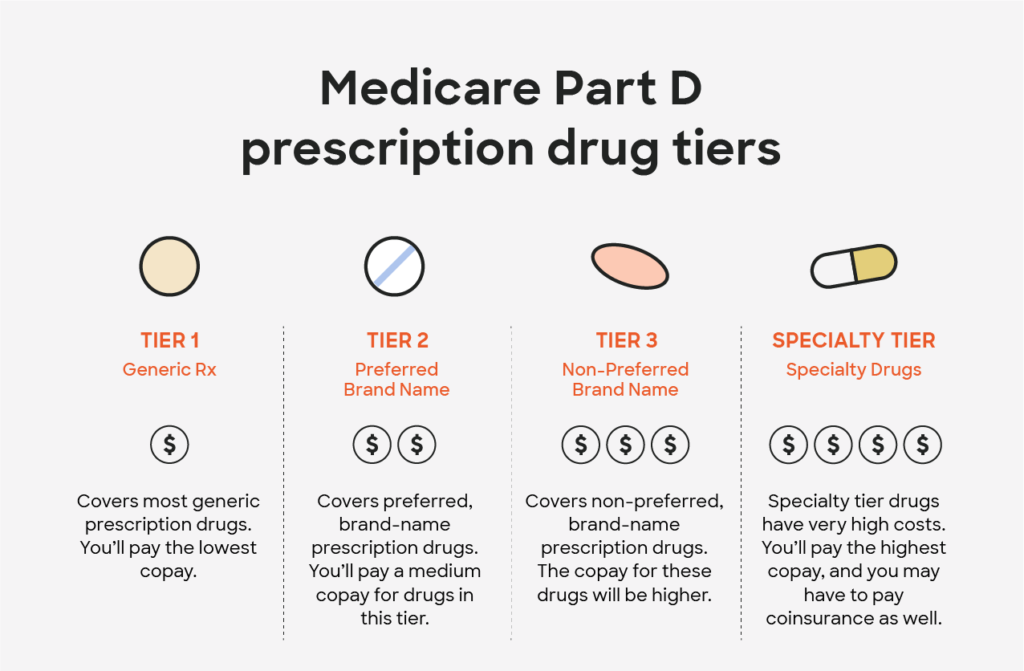

• Initial coverage period: Your share of each prescription is either a flat copayment (for example, $20) or a percentage of the drug’s cost (for example, 25 percent). Most plans have three or four levels (known as “tiers”) of copays, rising in price from the least expensive generic drugs through “preferred” brand-name drugs to “nonpreferred” brands and finally to specialty or high-cost drugs.

• Coverage gap (“doughnut hole”): Fifty percent of the discount for brand drugs is provided by their manufacturers; the rest of the discount for brand drugs and the whole discount on generics is provided by the federal government. If your plan provides any coverage in the gap, these discounts are applied to your remaining costs.

• Catastrophic level of coverage: Your share of each prescription is about no more than 5 percent of the cost of the drug. You would also pay a different price if you receive Extra Help or have additional coverage from elsewhere (such as retiree drug benefits or assistance from a state pharmacy assistance program).

Sign Up Period

Whether you choose a stand-alone Part D drug plan or a Medicare Advantage plan, you must enroll during a designated enrollment period:

– Your initial enrollment period (IEP), which runs for seven months, of which the fourth is the month of your 65th birthday.

– A special enrollment period (SEP), which you’re entitled to in certain circumstances

– The annual open enrollment period (Oct. 15 to Dec. 7 each year) when you can join a drug plan for the first time if you missed your deadlines for your IEP or a SEP, or switch from original Medicare to a Medicare Advantage plan, or switch from one Medicare Advantage plan to another, or switch from one Part D drug plan to another.

– The annual “disenrollment” period (Jan. 1 to Feb. 14) when you can opt out of a Medicare Advantage plan (regardless of how long or short a time you’ve been enrolled) and return to the original Medicare program. During this period you can also join a stand-alone Part D drug plan, provided that you had been receiving drug coverage from the Medicare Advantage plan.

– A general enrollment period (Jan. 1 to March 31 each year), if you missed your deadline for signing up for Medicare (Part A and/or Part B) during your IEP or an SEP. In this situation Medicare coverage will not begin until July 1 of the same year in which you enroll. You can sign up for a Part D drug plan or a Medicare Advantage plan between April 1 and June 30 to begin receiving drug coverage under it on July 1.

Insurance Our Agents Works With: